Revolutionize your Insurance Broker firm with Knowledge Work Automation

Transform your Insurance Broker firm's information management with the leading Knowledge Work Automation Platform. Deliver speed, accuracy, and value for your clients with information management which offers complete visibility on documents and processes, delivers engagements on time while enhancing collaboration, security, and ensuring compliance, all powered by M-Files.

Knowledge Work Automation for Insurance

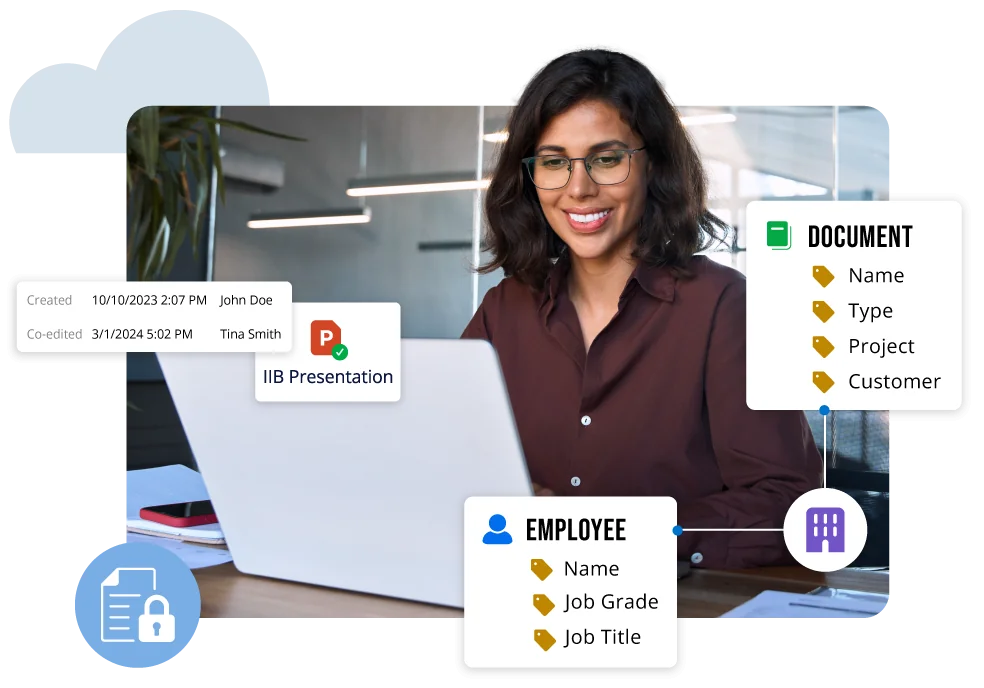

Streamline Document Management for Faster Access and Seamless Collaboration

- Organize, store, and share documents instantly allowing brokers, underwriters, and operational teams to access what they need, fast

- Enable the seamless management of everything from loss run reports, risk assessments or regulatory information to clients, and risk carrier correspondence.

- Easily organize information through automation or drag-and-drop functionality that saves time on searching and storing documents by utilizing metadata.

- Create, process, and access important client or engagement-related documents anytime, anywhere and capture coverage needs and create market presentations in minutes.

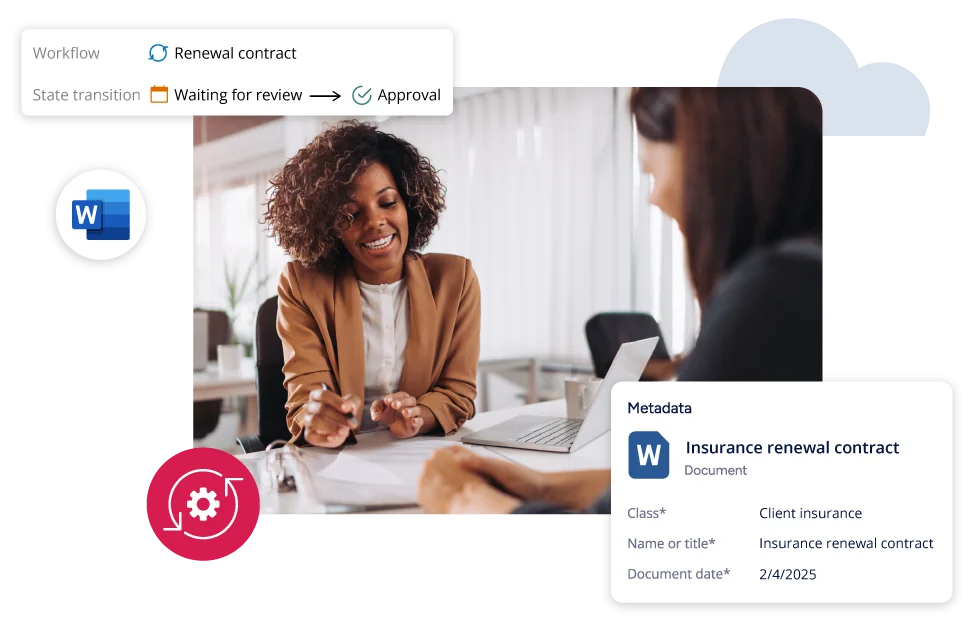

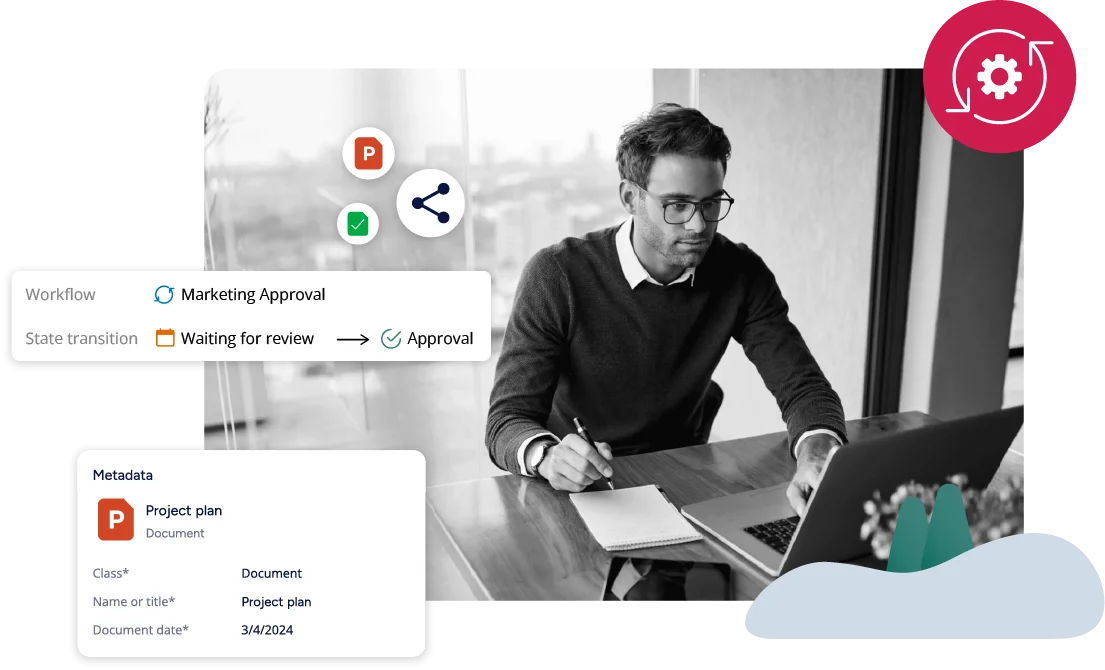

Standardize and Automate Processes to Save Time and Connect Your Firm

- Improve process efficiency and information accuracy with automated document workflows across client onboarding & renewals, underwriting, policy binding, and claims management.

- Automate review and approval processes for insurance applications and client proposals, market or underwriting presentations, client onboarding, risk assessments, or any other type of document.

- Document creation, internal/external collaboration, and approval and distribution workflows are integrated into the onboarding, renewal, and underwriting processes, thereby accelerating delivery through the client lifecycle.

Protect Client Information and Firm Reputation Through Automated Compliance Controls

- Minimize the risk of data loss with automated document permission controls tailored to employee roles, engagement phase, defined business rules, and/or regulatory standards, ensuring that information is kept confidential, secure, and compliant. Never worry about sensitive information being incorrectly accessed or stored ever again which protects your brand and reputation.

- Securely share and collaborate on documents with external audiences such as clients or risk carriers for a "single source of truth" without emailing content.

- Automate Compliance - Every action taken in M-Files is logged. Process automation helps ensure that compliance processes are followed. Retain documents with central access control, regardless of where they are being used.

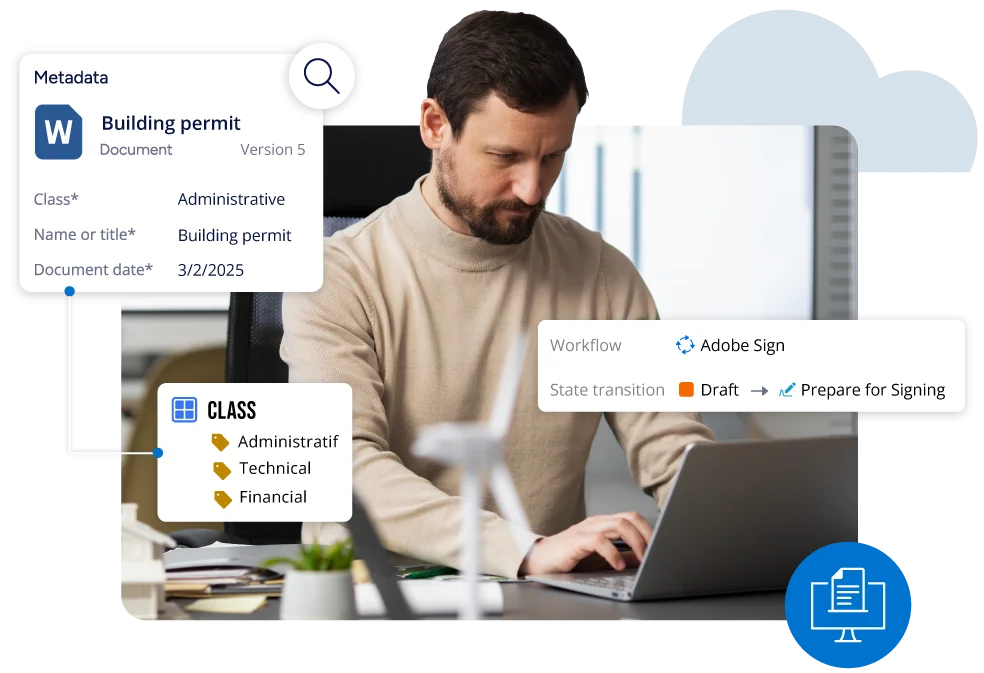

Keep Your Firm Connected Across All Stages of the Project

- Help your firm access content in context and in motion with integrations with major CRM platforms like Salesforce or Microsoft Dynamics 365. M-Files' flexible API and web services allow tailored integrations that meet your business needs.

- Review, approve, and sign documents from anywhere in real time with integrated e-signing platforms and co-authoring with Microsoft 365.

- Find, access, and manage all connected data, regardless of its storage repository, through the Microsoft 365 user interfaces.

Efficient Management Provides Quick Access To Critical Client and Carrier Information, Supporting Fast Decision-Making

M-Files is the leading platform for automating your insurance workflows to optimize efficiency. With M-Files, you can streamline and optimize the process of managing your client risk management and broker proposal documents , and files, enhance productivity, and access critical information quickly. M-Files innovative metadata-driven architecture, embedded workflow engine, and advanced artificial intelligence enables you to eliminate information chaos, improve process efficiency, and automate security and compliance.

We help Insurance Brokers and Risk Managers deliver speed, accuracy and value for their clients and firm.

Work Smarter with M-Files

The M-Files Impact

Up to 294% return on investment with low cost of initial entry and fast time to value.

How Successful Insurance Firms Use M-Files

Natsure

See how Natsure uses M-Files' document management system to win, onboard, and renew clients, ensuring secure information exchange and automated compliance.

Austbrokers Countrywide

Learn how Austbrokers Countrywide manages policies and regulatory standards with M-Files, ensuring compliance and enabling exceptional client service.

The Smarter Way to Work with Automation and AI

Industry Use Cases

Client Information Management

- Win and retain new clients successfully.

- Deliver client engagements smoothly.

Risk & Compliance Management

- Ensure client confidentiality and eliminate conflict of interest.

- Manage risk and enforce regulatory compliance.

Knowledge Management

- Facilitate knowledge capture and re-use.

- Accumulate intellectual capital.

Insurance Firms Endorse the M-Files Advantage

"By using M-Files to incorporate these automated workflows into its operations, Austbrokers Countrywide has been able to make significant inroads towards achieving its goals of growing the business without adding staff members and focusing on high-value client interactions."

Dilip Rao

Manager at Austbrokers Countrywide

"M-Files really helped us drive security. You can implement security right down to the file level if needed. When someone without clearance searches for it, it simply doesn’t appear. It’s a really useful tool."

Manager of Technology and Information Security

Medical Insurance Provider